So, you’ve found the one — a home that checks all your boxes, sparks your imagination, and just feels right. Now what?

Enter the Residential Purchase Contract — the legal document that takes your dream and makes it real. It outlines the terms of your offer and what happens next. At ARIVL, we believe in empowering you to understand what you’re signing — because while we’ve got your back every step of the way, you’re still in the driver’s seat.

This guide breaks down the key parts of the contract, what to look out for, and what questions to ask before you make your move.

🧾 What Is the Residential Purchase Contract?

It’s a formal agreement between the buyer (that’s you) and the seller. Think of it as the blueprint for your home purchase. Once signed by both parties, it’s legally binding. And trust us — understanding what’s in it can save you stress, surprises, and money.

🔑 Section-by-Section Breakdown

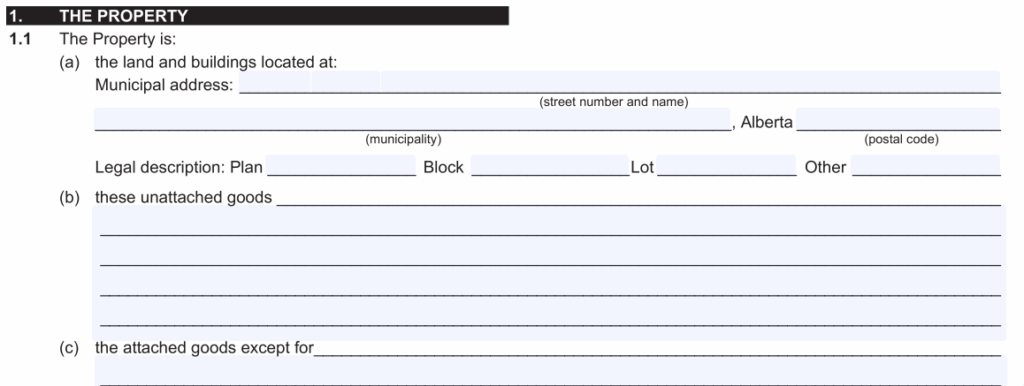

1. The Property & What’s Included

This section describes what you’re buying — not just the address, but also:

- Attached goods (e.g., built-in shelves, light fixtures)

- Unattached goods (e.g., appliances, blinds, garage door openers)

💡 What to look for:

Make sure what you expect to be included (washer/dryer, fridge, window coverings, etc.) is clearly written in the contract.

Ask yourself:

- Is anything I assumed would be included missing?

- Is the seller excluding anything I love?

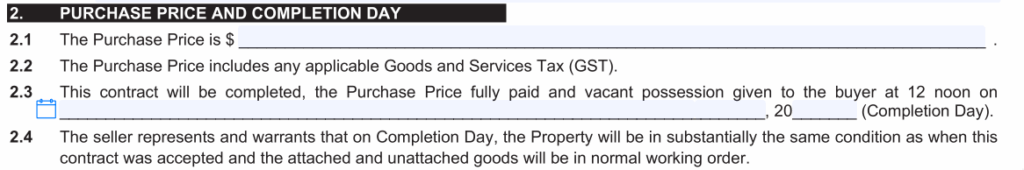

2. Purchase Price & Completion Day

This is the heart of the deal. It covers:

- The price you’re offering

- Whether that price includes GST (most resale homes don’t, but new builds might)

- The Completion Day — when the property becomes yours and you get the keys (typically at 12 p.m.)

💡 Pro tip: Make sure your financing, moving plans, and logistics align with this date.

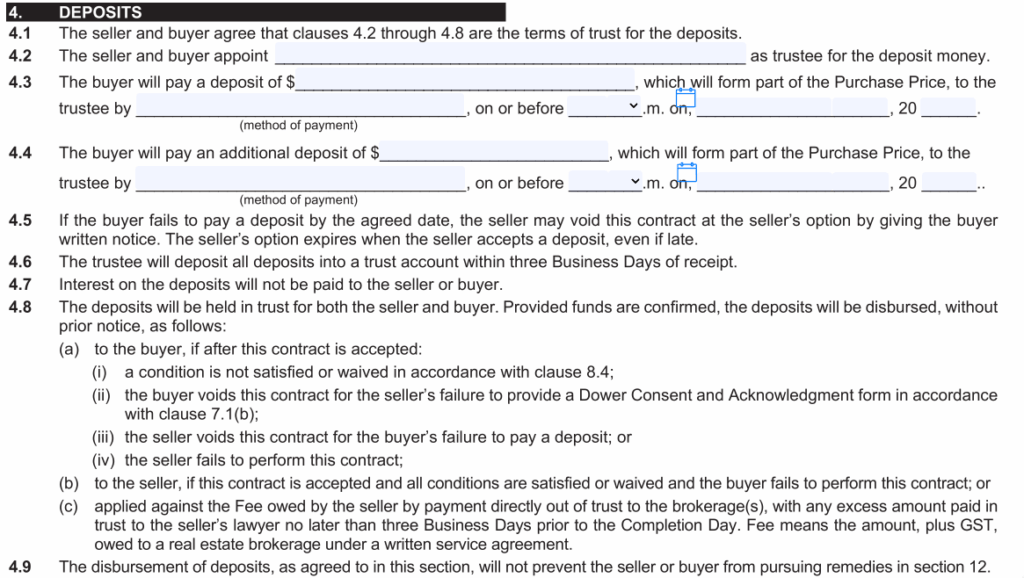

3. Deposits

Your deposit shows you’re serious. Here’s what you’ll see:

- Who holds the deposit (usually the listing brokerage or lawyer)

- How much and when it’s due

- What happens if the deal falls through

💡 Important detail: If you don’t pay your deposit on time, the seller may have the right to void your offer.

Ask:

- Is my deposit protected if I walk away for a valid reason?

- When and how do I pay it?

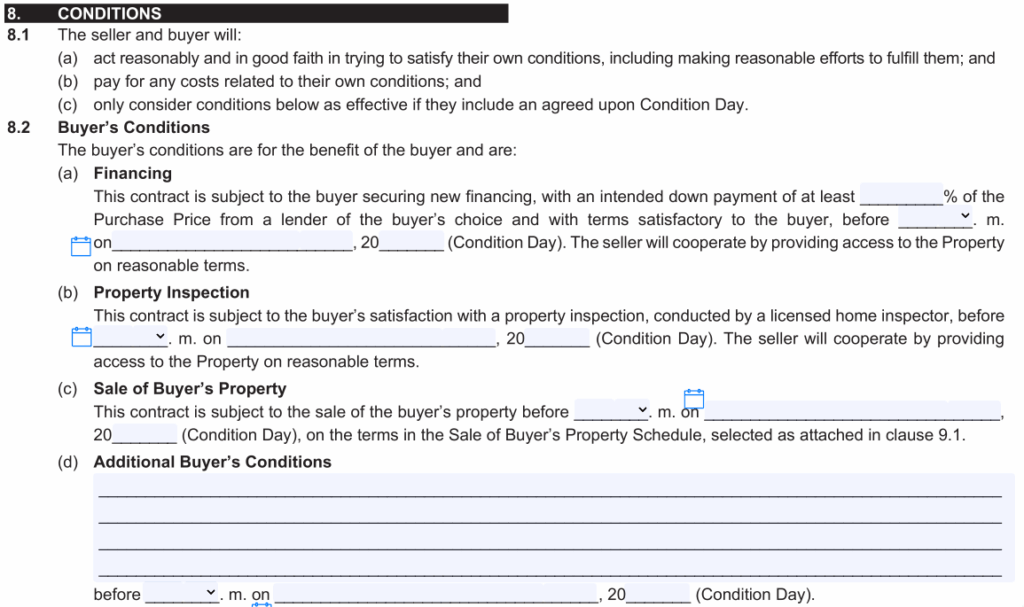

4. Conditions – AKA Your Safety Net

This is your out-clause. Conditions protect you from being locked into a deal that doesn’t make sense once more info comes to light.

Common conditions include:

- ✅ Financing Approval – Your mortgage lender says “yes”

- 🔍 Home Inspection – A licensed inspector checks for costly problems

- 🏠 Sale of Buyer’s Home – You have to sell your current home first

- ✍️ Condo Document Review – For condo buyers, this lets you review bylaws, reserve fund reports, etc.

💡 Watch the dates: Each condition has a deadline (called the “Condition Day”). Miss that, and your contract can automatically end — or go firm without you being ready.

5. Legal Disclosures & Seller Promises

The seller confirms:

- They have the right to sell

- The home doesn’t have hidden defects (like foundation issues you can’t see)

- It follows zoning bylaws and doesn’t encroach on someone else’s land

You still need to do your due diligence. That includes:

- Reviewing the Real Property Report (RPR)

- Verifying zoning, permits, and size

- Asking for documentation if anything looks DIY

6. Title & Legal Ownership

The title (a.k.a. proof of ownership) must be free and clear of financial burdens like liens or unpaid taxes. You may see references to:

- Easements (like utility lines)

- Encroachments

- Homeowner association agreements

💡 Your lawyer will help with this review, but it’s smart to flag anything unusual or unexpected.

7. Dower Rights (If Applicable)

If only one spouse is on title, and the property is the family home, Dower Rights may apply. This means the non-owner spouse must legally consent to the sale.

💡 Why this matters: If this form isn’t signed and submitted in time, you may have the right to void the contract.

8. Closing Process

On closing day:

- Your lawyer transfers the money

- The seller provides the keys and closing documents

- You take possession of the home!

This section also confirms who pays for:

- The Real Property Report (seller, unless agreed otherwise)

- Land title transfer and caveat fees (typically buyer)

- Adjustments like taxes, condo fees, and utilities

💡 Heads up: You need home insurance in place before possession. Your lender will likely ask for proof.

🗣️ Common Questions Buyers Ask:

What if something breaks before I move in?

The seller must keep the home in the same condition until Completion Day — and all included items must be in working order.

Do I need a lawyer?

Yes. Lawyers handle the transfer of funds, review title and documents, and ensure the deal closes properly.

Can I back out if I change my mind?

Only if you haven’t waived your conditions yet. Once you go “firm,” you’re legally committed — and backing out could mean losing your deposit or worse.

🤝 Buying With ARIVL Means Clarity & Confidence

At ARIVL, we don’t just hand you a contract and hope for the best. We:

- Walk you through every clause

- Help you understand your rights

- Customize your offer based on your goals

You’re always in the driver’s seat — we just help you steer clear of roadblocks.

💬 Let’s make your first offer a confident one.

Whether you’re just browsing or ready to write, our agents are here to help.

📧 Reach us at hq@arivl.ca

🌐 www.arivl.ca

ARIVL: Your Real Estate Adventure Awaits!