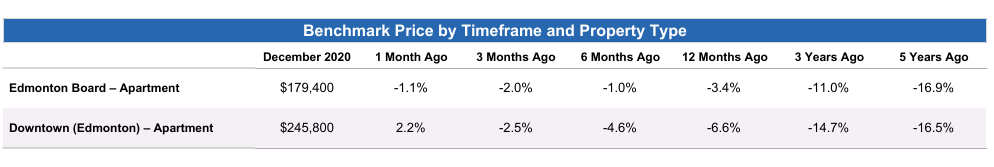

- Average sale prices up 1% for single family and down 2.1% for condos.

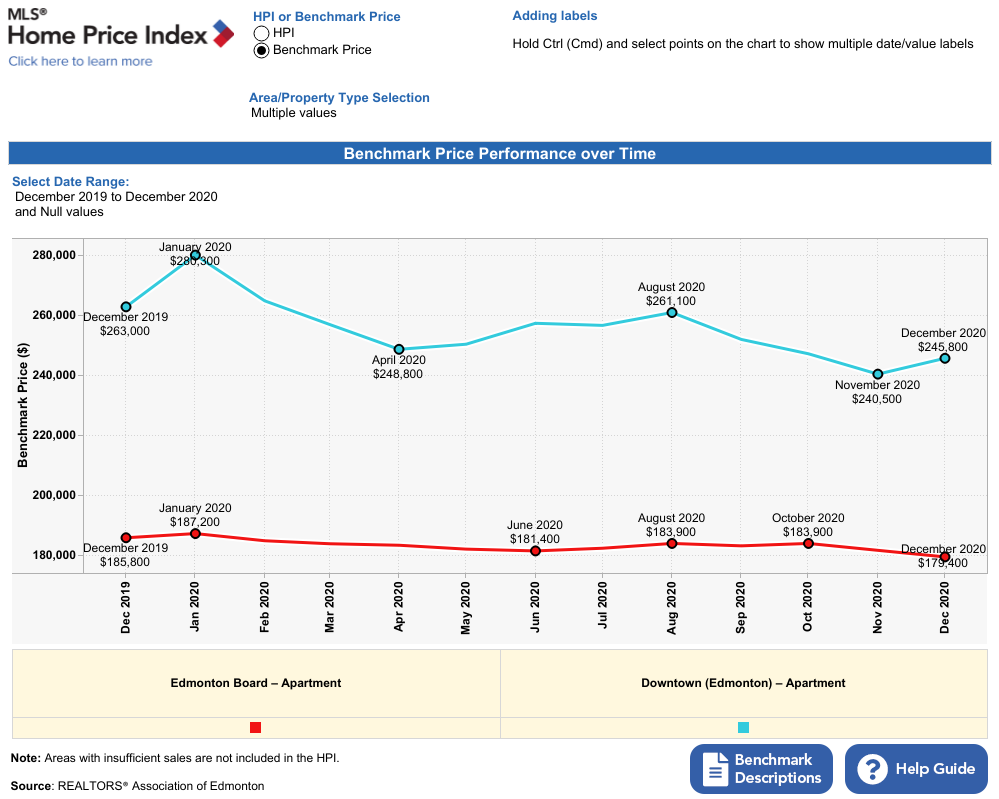

- Over all the market dipped with the initial phase of covid restrictions, recover in the market was seen in april/may with the market peaking in August.

- Hot trends include buyers upgrading for more space, acreage properties see increases in demand and larger homes doing well.

- First time buyer product including condo, townhomes, starter single family homes seen drops over all with the 1st time buyer market hunkering down their spending.

- Benjamin Tal, chief Economist for CIBC spoke re unprecedented government support for government dollar pushing the recovery growth. He sees the largest effected remain lower income service sector while majority of high wealth businesses doing well, matched with government support, lower cost of borrowing, he predicts the recovery process will be fast later part of 2021. Early 2021 will see slower activity as the vaccine plans roll out and market adjust.

- Service sector jobs have the unique ability to hire fast and recover quick. The vaccine roll out will be slow but gives the market a chance to finally normalize and prepare for recovery. Investments will benefit from higher oil prices coming back, low interest rates and a government that is business friendly. There is significant value for first time buyers on the market as prices found their bottom, as long as they can qualify, these are the best deals to take advantage of!

- Hot sectors post pandemic will include biotech, life science, advance manufacturing, software/IT services and food and service industries.

- The talent is here, the market condition is riped for new investment to come in. More can be done to promote the city, increase market opportunity but the groundworks is here to be a young, high tech city!

- Low interest rates is expected to continue. Market is expected to stabilize post the US election, we may see some softening in prices but no where near the extent of 2020. It will still be a tough later winter early spring market, recovery will be fast heading towards mid spring, early summer.